Newsletter 28th of January: Biggest Loser 2020 – Cinema

NEWSLETTER

28 January 2021

The cinema theatres have been hit hard by the pandemic. With many of them restricted or even closed, filmmakers and distributors have had to find new ways to reach the viewers. There are reasons to believe that this will have a long-term impact for consumers – also after the pandemic. The industry’s “window policies” are much debated – maybe even challenged. So, what will come instead?

As Mediavision has been pointing out earlier, several parts of the media industry experienced strong growth last year, in spite of the pandemic (even pushed by it). However, this is not the case for movie theatres. For example, the world’s largest cinema owner, AMC, recently secured USD 917 million in funding (USD 411 million in loan, USD 506 million USD through emissions) following speculations of an impending bankruptcy.

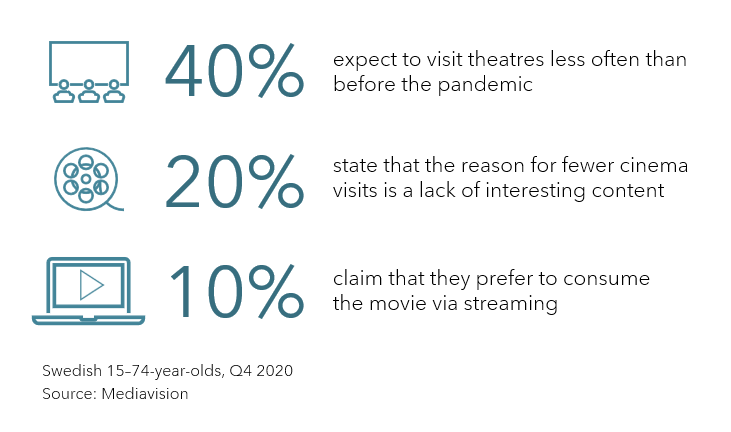

Cinema visits have fallen sharply all over the world, also in the Nordics, with large revenue losses as a consequence. The million-dollar question: Will consumers return when the pandemic is over? Mediavision has asked consumers. Based on Sweden, quite a few feel hesitant about going to the movies in the future, even after the pandemic. As many as 40% of Swedish 15–74-year-olds say that they expect to visit theatres less often than before. But it is not only restrictions that explain the decreased attendance. Several ‘block buster’ premieres have been delayed, and others have been released directly on TVOD or SVOD. To no surprise, close to 10% of the interviewed Swedes also state that the reason for fewer cinema visits is lack of interesting content. And 20% claim that they prefer to watch a movie via streaming rather than in theatres. This is a measurement of the temperature today – a lot can change when we feel safer again.

For 2021, several actors consider streaming as one measure to mitigate the losses. For example, Warner Media recently announced that the entire movie slate for 2021 will be released simultaneously in theatres and on its new streaming service HBO Max (coming to the Nordics in 2021). According to Deloitte, release to PVOD/TVOD also means that the studios will retain a larger share of the revenues than before. Studios running their own streaming services could use new movies to attract subscribers (and prevent churn).

And as we all know, the streaming market is highly competitive. For example, both Netflix and Sky have announced massive film slates for 2021. Netflix will release one new movie (originals and licensed) each week in 2021. So the question remains: Will streaming revenues compensate for losses in cinema theatres?

Industry News

HBO Max Activations Doubled in Q4

AT&T’s Q4 earning report disclosed that activations (existing customers of HBO are entitled to activate HBO Max at no extra cost) for HBO Max rose to 17,2 million in the quarter, a doubling since Q3. The release of Wonder Woman 1984 is stated as a driving factor.

Spotify Tests Audiobooks with Classics

Nine exclusive recordings of classic audiobooks are now available on Spotify – including Jane Austen’s Persuasion and Charlotte Bronte’s Jane Eyre. The titles are all part of the public domain, but the original recordings are exclusive to Spotify.

Netflix Launches “Instant Play” Globally

A new feature is set to launch on Netflix, that instantly selects content a subscriber wants to watch. However, the feature where viewers are presented with a traditional, linear schedule has been put on hold.

Susanne Bier to Direct New Hollywood-Drama

Following the recent success with the HBO-drama The Undoing, Susanne Bier will embark on a new Hollywood-project. Showtime is producing the new series, portraying former US first ladies.

The Office (US) Takes 9% of US Streaming Share

According to data from streaming aggregator Reelgood, NBCU’s decision to bring The Office US to its streaming service Peacock has been highly successful. In the first week of 2021, the show accounted for 9,2% of all streaming in the US.

Mediavision in the News

Streaming records for Sweden

According to Mediavision, the covid-19 pandemic has had “substantial effects” on the state of the streaming market in the Nordic country and that it has “accelerated the digital transformation.”

Swedish streaming market records 2020 record

Viewing to Swedish streaming services scaled new heights in 2020, according to the Stockholm-based Mediavision consultancy.

Swedish VoD penetration reaches 70% in Q4, up 10 percentage points year on year

Use of streaming services in Sweden increased substantially in 2020, despite a slowdown in growth in the first quarter, according to consultancy Mediavision.

Netflix nådde en ny milstolpe med 200 miljoner abonnenter

Kombinera hitserier som The Queen’s Gambit och Tiger King med ett år av självisolering, så får du ett vinnande koncept. Netflix publicerade i veckan sina siffror för det fjärde kvartalet och kunde rapportera att de nått en ny milstolpe.

Rejäl tillväxt på den svenska streaming-marknaden under pandemiåret

Streamingtjänsterna för video växte rejält i Sverige i fjol – både i betalande kunder och antalet tittare. Det visar Mediavisions analys av 2020.

Nordic monthly media spending reaches EUR 70 in autumn, little changed from before pandemic hit

The Covid-19 pandemic has not reduced Nordic consumers’ media spending so far, according to Swedish consultancy Mediavision.

Spotifys stora skifte: ”Behövde en ny story”

Spotify har hittills lagt över 8 miljarder kronor på att bli världsledande på poddar i bolagets största strategibyte sedan starten. Varför vill den svenska tech-jätten få dig att lyssna på annat än musik?

Nordic consumer spend unabated by pandemic

The Covid-19 pandemic has failed to alter the spending habits of the Nordic consumer. Stockholm-based Mediavision reports the average household in Denmark, Finland, Norway and Sweden spent approximately €70 per month on media during fall of 2020…

Nordiska medieutgifter stabila trots pandemi

Coronapandemin har inte påverkat de nordiska konsumenternas vilja att betala för media. Det genomsnittliga hushållet har lagt cirka 70 euro per månad, motsvarande 710 kronor, på media under hösten 2020 vilket är i stort sett oförändrat jämfört med fjolårsperioden.

Nordiska medieutgifter stabila trots pandemi

Coronapandemin har inte påverkat de nordiska konsumenternas vilja att betala för media. Det genomsnittliga hushållet har lagt cirka 70 euro per månad, motsvarande 710 kronor, på media under hösten 2020 vilket är i stort sett oförändrat jämfört med fjolårsperioden.