Newsletter 26th of May: Who Benefits When Audio Market Leaders Join Forces?

NEWSLETTER

26 May 2021

Last week Storytel and Spotify announced that they will enter a partnership, making audiobooks available to Storytel subscribers via Spotify’s Open Access Platform. This is all good news for consumers that subscribe to both services, as they will now get easier access. But who is the real winner in this deal when it comes to the actors – the content or platform provider?

Both Storytel and Spotify are leading in their respective segment of the audio market. Spotify has dominated the music streaming market since the beginning and has almost 160 million subscribers across 178 markets. In Sweden, Mediavision concludes that 1.6 million subscribed to the premium service in Q1 2021. The Swedish music streaming market is mature and stagnating; just below half of all households have a music streaming subscription and penetration has been stable for the past two years.

The Swedish audiobook market, on the other hand, has grown substantially during the same period, i.e. since Q1 2019. But this market is now also showing signs of maturity. Penetration is almost 20% and growth has gone from double to single digit over the past year. Storytel is the leading actor, but on a significantly smaller segment of the audio market which, in this case, makes its position weaker than Spotify’s. Competition is fierce and there are other upcoming services like Nextory and Bookbeat.

Both Spotify and Storytel find themselves “trapped” on a maturing market, but with different challenges. Growth will need to be generated from other areas, which can be either new markets (as Storytel gaining access to new potential customers via Spotify) or new content offerings to fight churn (as Spotify gaining access to Storytel’s library). In that sense both actors appear to gain from the partnership. But is it really a win-win-situation in the long run?

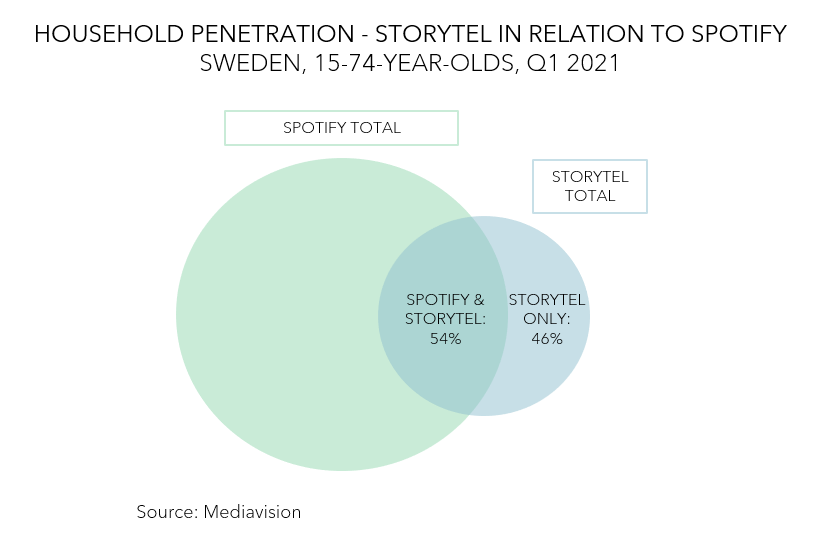

To begin with, Mediavision analysis points at Spotify being almost five times the size of Storytel in subscribing households – and that is only on the Swedish market. In stock market value, the factor is 25 (Storytel is valued at approx. 15 bn SEK and Spotify at 45 bn USD). Spotify holds a dominant position on the audio market and craves content to feed consumers and increase stickiness. This is where Storytel comes into the picture. The question for Storytel is what the long-term value of this partnership is. It will gain access to new potential customers at the risk of making Spotify even stronger in building customer relations. E.g who would the consumer turn to if they had to choose between Spotify and Storytel? Well, the figures give us some guidance: in Sweden, more than 50% of Storytel’s customer base overlap with Spotify. In addition, share-of-listening is 10 times higher for Spotify than for Storytel. When the partnership was announced Storytel’s stock price jumped +20% in just one day. The Spotify stock price barely moved. The market seems to think that Storytel is to gain the most from this partnership. Time will tell.

Industry News

Netflix to Enter the World of Gaming?

According to a source ‘close to the matter’, Netflix is looking to hire an executive to oversee its expansion into videogames. Netflix has earlier experimented with interactive programming with movies and created games based on shows.

O2-Virgin Media Merger Gets Formal Approval

The UK’s Competitions and Markets Authority (CMA) has formally approved the proposed merger of Telefónica’s O2 and Liberty Global’s Virgin Media. The merger was first announced in May 2020 and is expected to close on June 1st.

TikTok Radio Launching on Sirius XM

TikTok, SiriusXM and Pandora have joined forces to launch TikTok Radio, a full-time SiriusXM music channel due to launch online this summer. The station will be presented by TikTok creators, tastemakers, and DJs.

Mediavision in the News

Efter jätteaffären – så stora blir HBO och Discovery i Norden

Nyligen stod det klart att Warner Media och Discovery bildar en ny streamingjätte. Warner Medias HBO och Discovery Plus blir därmed ytterligare en stark utmanare på streamingmarknaden.

Streamingjättar i kamp: ”Enorm muskelkraft”

Hur många streamingtjänster tål din plånbok? En rad stora affärer spås rita om kartan rejält. Samtidigt har Jeff Bezos Amazon siktet inställt på sport.

Nordic implications of Discovery, WarnerMedia merger

This week saw yet another mega merger announced in the world of TV and streaming. In a multi-billion deal, AT&T will combine its WarnerMedia with Discovery.

Clubhouse-nedlastinger ned 72% i mars

Man må ikke laste ned en app mer enn én gang for å bruke den jevnlig, og Clubhouse er totalt lastet ned mer enn 15 millioner ganger, men tall fra det svenske analysefirmaet Mediavision viser at antallet nordiske brukere av appen er begrenset.

Netflix-veksten avtar: - Flere som slåss om kundene

De ferske kvartalstallene til strømmetjenesten Netflix viser at selskapet kun fikk fire millioner nye abonnenter i første kvartal. Strømme-tjenesten Netflix fikk fire millioner nye abonnenter i første kvartal.

Netflix växer blygsamt i Norden – konkurrensen oroar inför rapport

Streamingtjänsterna såg sin guldålder under 2020 men nu hopas orosmolnen över bolagen. Marknadsledaren Netflix väntas bjuda på en ljummen rapport för det första kvartalet.

Sweden: Families prefer Disney+ over Netflix

The launch of Disney+ in 2020 fundamentally changed the competitive landscape for streaming in Sweden in many ways – but perhaps most notably in the battle over families with young children.

Netflix likely to report 5% Q1 Nordic subscriber growth vs 8% market growth rate

Swedish consultancy Mediavision says it predicts that Netflix will report a 5 percent increase in Nordic customers for the first quarter of 2021, or a rise of 200,000 subscribing households since Q1 2020.