Newsletter 18th of November: Are Podcast Listeners Ready for Walled Gardens?

NEWSLETTER

18 November 2020

Digital audio is booming, and podcast listening is the talk of the town right now. Payment rates for podcasts, however, are still low compared to other streaming services. According to press reports, Spotify may be considering podcast subscription plans. The question is, are podcast listeners ready for walled gardens?

Digital audio is growing in the Nordics, with streaming music in the lead. In Q3, more than 50% of Swedes listened to digital music, audiobooks and/or podcasts an average day. In the very center of attention are podcasts – obtaining as big a share-of-listening as traditional radio in young targets (15-34-year-olds). However, the growing popularity is not reflected in ad spend. Mediavision estimates that podcast ad revenues amounted to roughly a tenth of that of commercial radio in 2019 – fairly small in relation to the number of listeners (but also reflecting a highly fragmented market). Since the industry is still young, this might of course change. Another possible way forward may instead be consumer revenues.

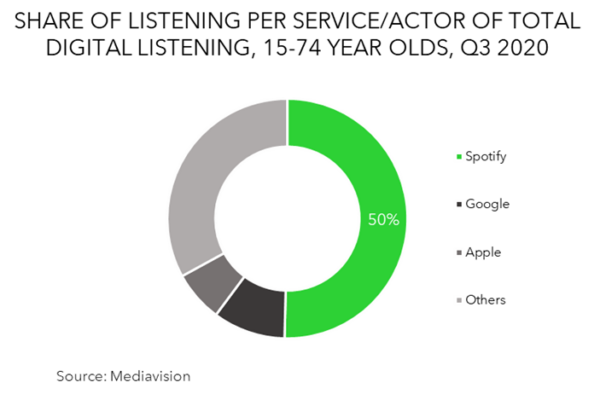

Looking specifically at Sweden, podcast listeners actually claim quite a strong willingness to pay for the content, especially if it is exclusive. And there are certainly many ways to package premium content. For one, as rumored in the case of market leader Spotify, you could choose a “lock-in” strategy by offering paid podcast subscriptions. Mediavision analysis points at a Spotify share of digital listening at 50% and a 34% share of podcast listening. This may be enough to introduce a subscription package, focusing on “spoken sound”, but that could also mark the end to the strong performance we have seen so far. Maybe Spotify is better off using podcasts as a way to increase listening and thereby as an effective retention tool – i. e. keeping today’s churn on a low level?

Another alternative may be subscription services entirely focused on podcasts where listeners pay for access to exclusive content. Swedish platform PodMe is an example of such a platform, which recently has acquired exclusive rights to some very attractive podcast titles (including Shulman show and Fördomspodden). As of today, the service gathers 3% in daily reach among podcast listeners. Another example, on the global arena, is Luminary. After launching in 2019 (with substantial financial backing), it only amassed 80 000 subscribers in its first year of business. The conclusion? Well, a bit early still but not an immediate success for the pure-pay strategy.

Hence, the question for the industry remains: Is the podcast audience truly prepared to pay for content? Could subscriptions be the way forward in securing solid revenue streams? The answer may be that the podcast industry needs its’ equivalent of House of Cards or Game of Thrones – strong titles to push listening. We know for sure that content is king. And it needs to be paid for one way or another, sooner or later.

Industry News

Netflix Produces Islandic Series

The islandic series “Ófærð” will get a sequel on Netflix with the new title “Entrapped”. The series will play out 2 years after where the second season left off and will premiere on Netflix in 2021.

NENT to Show 2023 FIFA Women’s World Cup

NENT has acquired the exclusive rights to the 2023 FIFA Women’s World Cup in Sweden, Norway and Denmark. All 64 matches will be available live on Viaplay, with selected matches on NENT Group’s free-TV channels.

Nextory Boasts 165 million in Financing Round

Ahead of continued global expansion, Swedish audiobook subscription service Nextory has acquired 165 million SEK in a new financing round. The service will launch in the Netherlands next month.

Slight Recuperation for Norwegian Advertising

The Norwegian Media Agency Association reported that after the first ten months of the year, advertising revenue via the media agencies had declined by 15% compared YOY. However, in October a slight upturn is evident.

French Broadcasters Launched Streaming Service

TF1, Télévisions och M6 launched the streaming service Salto in early November as a joint venture. The service is priced as 6,99 EUR per month and offer over 10 000 hours of content.

India Imposes Restrictions for Streaming Services

The Government of India has put forward proposals entailing online news, social media and streaming platforms to be subject to state regulation regarding content. The platforms have so far only been subject to the Ministry of Technology, which does not regulate content.

Premier League Suspends PPV-Service

Matches which have not been selected by the rights holders Sky Sports and BT Sport have been offered for £14,95 per game, but now the Premier League suspends its PPV-service. All matches will now be shared between the Sky Sports, BT Sport, Amazon and the BBC instead.

ViacomCBS Discontinues Niche Services

In a strategic move to consolidate subscription streaming efforts around Paramount+, relaunching next year, ViacomCBS will terminate some of its niche services, including for example MTV Hits.

Historic Deal Shrinks Theatrical Window

Universal and Cinemark has entered a historic deal regarding theatrical windows. Any Universal film that doesn’t open to $50 million or higher will be approved by Cinemark’s to debut on PVOD after 17 days, versus the previous timeframe of a month.

Disney+ Expected to Reach 194 MN Subs by 2025

According to new estimates from Digital TV Research, Disney+ will boast 194 million subscribers worldwide by 2025. Amazon will reach 167 million subs in 2025, HBO Max will get to 28.5 million, and Apple TV+ will hit 13.4 million according to the forecast.

Mediavision in the News

Poddindustrin exploderar – men de stora intäkterna saknas

Poddar är mycket mer än en kändisduo som snackar med varandra. Dramaserier, gameshows och spinoffs på böcker är nya format under utveckling.

Netflix slips but Swedish SVOD hits new high

During the past year, Swedish households have purchased an additional 700, 000 new SVOD-subscriptions and this has led to the paid video services market in the third quarter of 2020 reaching a new record level with strong growth…

Swedes add 700,000 SVOD subscriptions, Netflix with loss for the first time

Swedish households purchased an additional 700,000 new SVOD-subscriptions during the past year.

Netflix drops subs in increasingly competitive Sweden

Despite adding an extra 2.2 million subscribers globally in the most recent quarter, Netflix has actually lost users in Sweden for the first time in almost a decade.

Swedish SVoD subscriptions rise 700,000 year on year in Q3 amid stacking, Netflix loses customers

Swedish new SVoD subscriptions have risen by 700,000 in the year ending 30 September 2020, said consultancy Mediavision.

Swedish SVOD Subs Reach New Record Level

During the last year, Swedish households have purchased an additional 700,000 new SVOD subscriptions, though Netflix lost subs for the first time since its launch in the country.

Netflix tappar mark i Sverige samtidigt som marknaden växer

Svenska hushåll tecknade ytterligare 700 000 strömningsabonnemang under det tredje kvartalet och betalda videotjänster nådde därmed en ny rekordnivå.

Första kundtapp för Netflix i Sverige

De svenska hushållen har under det senaste året köpt ytterligare 700.000 nya så kallade SVOD-abonnemang (streamad video), men vad gäller Netflix har antalet användare i Sverige minskat, enligt analysföretaget Mediavision.