Newsletter 23rd of February

NYHETSBREV

23 February 2022

These are the topics we focus on in this week’s newsletter:

- Mediavision Industry Outlook 2022

- Closing Beijing Winter Olympics 2022

- Starzplay Expands in the Nordics

WHITE PAPER

Mediavision Industry Outlook 2022

For the third consecutive year, Mediavision has asked stakeholders in the Nordic media industry to share their view on the future development of the Nordic market. The results of this survey, supplemented with reflections and analysis from the Mediavision team, is presented in Mediavision Industry Outlook 2022 – which is now available to all of you upon request – please send an email to julia.gotborg@mediavision.se to get your hands on a copy.

These were some of the main takeaways from this year’s edition.

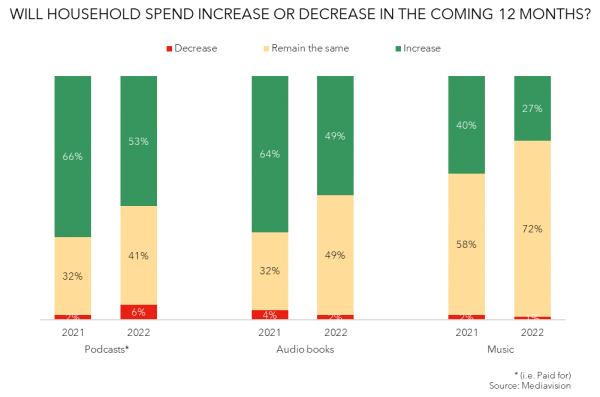

Audio: The industry expects diminishing growth for household spend on audio

About half of all respondents believe that household spend on audio book subscriptions and podcasts will increase in 2022. However, it is still less than last year. Mediavision concluded¹ that in 2021, more than 100 000 new audiobook subscriptions were added on the Swedish market – and growth was recorded in all Nordic markets.

Paid podcast services are yet to gain a strong foothold in the Nordics, the largest pan-Nordic player is Patreon which attained a 3% household penetration in Fall 2021². Investments in the podcast area were heavy in 2021 and it seems this trend will prevail – both Apple and Spotify have introduced new tools for podcasters to monetize content.

About a quarter (27%) of the respondents believe that household spend om music will increase, which is less than last year (40%). Spotify is the undisputed market leader, with other global services as main challengers – but DK constitutes a special case as local actor Yousee Music is its prime competitor².

¹ Mediavision press release “Mediavision: 120 000 nya hushåll med ljudboksabonnemang hittills 2021” (2021-12-13), Mediavision analysis ’Insikt: Ljudmarknad’ ² Mediavision analysis ’Insight: Nordic Media & Markets’

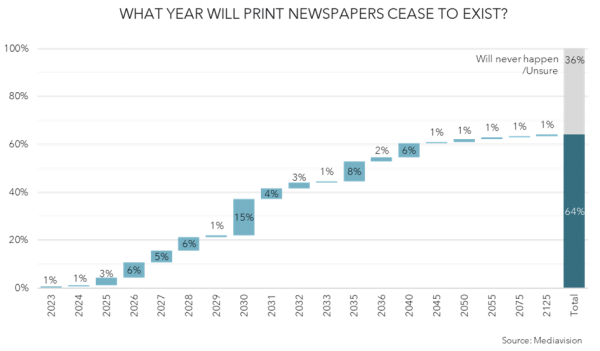

Text: The industry believes that print will remain resilient

Most respondents believe that household spend on digital magazine subscriptions will remain the same in the coming 12 months. As of Fall 2021, 29% of Nordic HHs spend on text media was digital – which is less than for audio and video – showcasing the significance of legacy business in text ¹.

Although the Nordic market for newspapers is becoming increasingly digital, only about half of all subscriptions are exclusively digital today².

The respondents believe that print will remain resilient for quite some time still. 36% of the respondents believe that print newspapers will never by fully replaced by digital editions. 38% believe in a market shift by the year of 2030, another 24% by 2040.

¹ Weighted Nordic average, 15-74-years-olds ² Mediavision analysis ’Insight: Nordic Media & Markets’

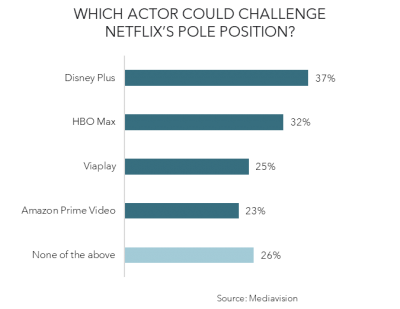

Video: Netflix’s pole position may be challenged by Disney and HBO

Following multiple years of double digit SVOD growth, Mediavision has identified signs of maturity – but also disruptive forces that may boost growth¹.

The industry believes that growth will continue in 2022; a vast majority (63%) of the respondents believe that household spend on SVOD will increase. However, this is a smaller share than when the same question was posed a year ago – back then, close to 90% believed that spend would increase. Conversely, 85% of the respondents believe that SVOD-subscriptions will increase – perhaps an expression of increased stacking and lower average expenditure per sub.

Netflix has had a pole position on the Nordic market ever since it was launched back in 2012, despite significant changes to the competitive SVOD-landscape. However, the vast majority (73%) of the respondents believe that one or several actors could challenge Netflix’s pole position before 2025.

Disney Plus and HBO Max are considered main contenders – both services have performed strong (re)launches in the last two years. HBO added +635’ households in the Nordics following the transition from Nordic to Max in Oct 2021 – which put HBO back in the top three of Nordic SVOD services¹.

¹ Mediavision analysis ‘Insight: Nordic TV & Streaming’

|

|

Netflix to invest USD 45 M annually in French, European movies

Meta to launch Facebook Reels in more than 150 countries

Norstedts full-year 2021 performance the strongest in 10 years

NENT Group closes SEK 600 million bond issue

Spotify to acquire two major podcast tech platforms

Storytel presents year-end report for 2021 |

SPORTS

Closing Beijing Winter Olympics 2022

The Olympic Winter Games in Beijing have now come to end. The games turned out especially successful for Norway – at the top of the medal league with a total of 37 medals (of which 16 were gold). Meanwhile, the Swedish athletes scored most medals to date in any Winter Olympics, gathering a total of 18 medals (8 of those were gold). Finland placed 5th in the medal league with a total of 8 medals – while Denmark did not rack up any top placements.

Mediavision’s Nordic Sports Analysis 2021 concluded that winter sports are among the top 3 sports with the highest interest in Finland, Norway, and Sweden – however, Denmark stands out with winter sports placing as the 8th most popular sport. Regarding Ice Hockey, this sport attracts tremendous interest in both Finland and Sweden – while placing 9th in Denmark and 8th in Norway.

In Europe, Discovery reported that the opening week of competition at Olympic Winter Games Beijing 2022 drove “massive increases in engagement on Discovery+ and Eurosport digital services, as well as strong overall linear viewership across Europe”. Eight times more viewers were streaming Olympic content compared to the same period (the opening week) for the Olympic Winter Games in PyeongChang 2018.

Discovery has also shared some highlights in terms of viewing from the broadcasts across the Nordics.

- The Finnish male ice hockey team’s final game was the most watched event of the entire Olympics among Finnish individuals aged 25–54. The final game was watched by more than 2 million on TV5, with an average number of 1.239 million viewers during the broadcast.

- The pursuit race of women’s biathlon racked up an average audience of 780.000 in Norway – at most, 901.000 watched the broadcast.

- The biathletes’ mixed relay was watched by 672.000 people on average in Norway and at most, close to 800.000 followed the race for the gold medal. This translated to a viewer share of 87% in the total population.

- A total of 17 broadcasts from the Olympics on linear channel 5 in Sweden attracted an audience surpassing a million.

In the US, the Olympics have been aggressively promoted by NBCUniversal via TikTok. Ahead of the event, news broke that NBCUniversal would team up with TikTok for an advertising partnership to promote the network’s coverage of the Olympics. Videos range from short clips of the competitions to athletes performing ASMR. By the end of last week, the @NBCOlympics account had racked up a total of 57 million likes and more than 1.8 million followers.

|

|

Nordic Sports AnalysisThis analysis provides an in-depth analysis of consumer interest, willingness to pay and pay rate. It covers +90 specific sports rights in the Nordics and offers a comprehensive insight on how the consumers value sports rights. It is also compares sports rights in the different Nordic countries. |

|

|

Viaplay to show new DreamWorks Animation TV series

Finnish series Lakeside Murder sold to international markets

Spotify rumoured to have paid USD 200 M for Joe Rogan podcast

Kanye West to release next album exclusively on Stem Player

Paramount+ subscriber growth surpassed expectations in Q4 -21

‘Lord of the Rings’ film and gaming rights up for sale |

NORDIC SVOD

Starzplay expands in the Nordics

Last week, the already substantial supply of streaming services in the Nordics was expanded even further – as Lionsgate owned Starzplay entered the fray as a standalone subscription service.

Part of Starzplay’s content has already been available to Nordic consumers via a partnership with NENT Group’s Viaplay as of December last year. Among the content presented on Starzplay is original series Gaslit starring Julia Roberts and Sean Penn, The Girl from Plainville with Elle Fanning och Becoming Elizabeth – an upcoming drama series that will tell the story of teenage Elizabeth I. According to Superna Kalle, President of International Networks at Starz, local original productions might be coming to the service going forward.

In the Nordics, Starzplay is priced around EUR 5,5.

|

|

Netflix’s Marvel originals leave Netflix as Disney reclaims rights

Strong 2021 report from Bokusgruppen caused stock to rise

Aggressive price hike of paper for newspapers persists

Danish Naja Marie Aidt awarded Swedish Academy Nordic Prize

Podimo enters collaboration with sports podcaster Mediano

Netflix sets ‘Stranger Things’ S4 premiere date – to end post S5 |

Mediavision in the News

Så mycket dyrare har det blivit att strömma film och serier – SVT

Tufft år för svenska ljudboksbranschen – tillväxttakten halverades – Dagens Industri

Could TikTok spur growth of AVOD in the Nordics? – Senal News

Bråket visar varför Spotify behöver Rogan – SVD

Poddarna – makten och pengarna – SR

Därför kom Clubhouse-hysterin för ett år sedan – och därför dog den – SR

Hushållen tecknar fler abonnemang – rekordsiffror för S-SVOD under 2021 – Dagens Media

Industry Events

CTAM Europe Executive Management Programme: 20-25 March 2022, Fontainebleau, France

MIPTV: 4-6 April 2022, Cannes, France

NEM Dubrovnik: 6-9 June 2022, Dubrovnik, Croatia

* Mediavision will attend

** Mediavision will present