Newsletter 25th of October

NYHETSBREV

25 October 2023

These are the main topics this week:

- Mediavision: Household media spend reaches new record level in Q3

- Significant overlap between Spotify and audiobook services in Sweden

- The Q3 earnings season continues

MEDIA SPEND

Mediavision: Household media spend reaches new record level in Q3

Household spend on media continues to rise in Sweden. In Q3, average monthly spend on media reached a new record level of SEK 855 on average. Despite a weaker economy, household media spend has increased by 6% YOY. This is confirmed by Mediavision in its Q3 analysis of the Swedish media economy. Growth is primarily driven by an increase in media purchases, rather than subscriptions. Especially purchases of cinema tickets are increasing, nearly 40 percent YOY.

Despite a weakening economy, household spend on media services is on the rise. In the third quarter, a new record level of SEK 855 per month was noted, which represents a SEK 45 growth (6%) YOY. The analysis covers all types of media purchases, such as subscriptions for newspapers and video services, as well as individual purchases, like cinema tickets. Mediavision can confirm that growth is primarily driven by increased spend on cinema, even though individual purchases of, for example, video games have also increased. During Q3, on average, 25 percent of households bought at least one cinema ticket per month, which is a significant increase compared to the same period in 2022. A strong contributing factor is the release of blockbusters Barbie and Oppenheimer, which both attracted a large audience. However, despite the increase, monthly reach for cinema remains significantly lower than before the pandemic.

Read up on the full press release here, with commentary from Mediavision’s CEO Marie Nilsson.

|

|

Insight: Nordic Media & MarketsThis analysis tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. Published biannually. |

|

|

SR makes podcast episodes exclusive to their own app

Bonnier News’ Super package reach 100,000 subscribers

X to launch two new premium tiers

Apple to invest USD 1 billion per year in generative AI

|

AUDIO

Significant overlap between Spotify and audiobook services in Sweden

For some time, rumors have been circulating regarding a possible Spotify entry into the Swedish audiobook market. A few weeks ago, Spotify included audiobooks in the premium subscriptions in Australia and the UK. If this should also be launched in Sweden, it could have a substantial impact on the market in Sweden, considering Spotify is the largest subscription service in the country.

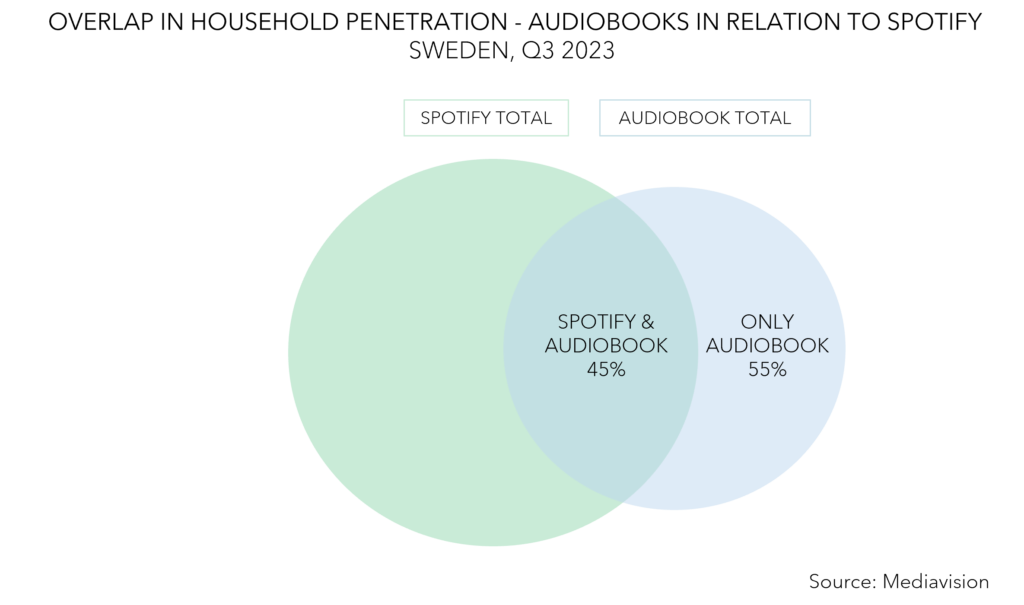

Currently, over a million households pay for an audiobook service in Sweden, and nearly half of them also pays for a Spotify subscription. This is shown by Mediavision’s latest figures of the Swedish audio market. This means that close to half of the existing audiobook households also would gain access to 15 hours of audiobook listening via Spotify if the feature were to be launched. Thus, Spotify’s overlap with audiobook households is substantial.

As the content supply is close to identical between the different audiobook services, competition is instead price focused. The effect is a significant customer turnover, or “churn”. For Spotify, on the other hand, churn is very low, even when compared to actors such as Netflix. This is an advantage for Spotify in general, and even more so if audiobooks were to be included in the offer.

A hypothetical Spotify entrance would most likely affect both price levels and competitiveness in the Swedish audiobook market. If included in a Spotify subscription, the number of audiobook households would essentially double. This penetration boost would follow after some time of rather weak development in Sweden.

However, Spotify’s audiobook library needs to be equivalent in size to other services in order to compete heads-on. Today, Swedish market leader Storytel offers over 1 million titles – to be compared to Spotify’s 150,000. And perhaps even more important, Spotify must offer Swedish-language content. The audiobook market is very local, as most listeners prefer books in their native language. This suggests that Spotify is likely to choose larger language areas, and in particular English-speaking markets, for its initial venture. More on Spotify and Q3 results below.

|

|

Insikt: LjudmarknadThis analysis provides in-depth understanding of the entire audio market – including audiobooks, music, podcasts, and radio. The analysis focuses on the digital transformation of both listening and consumer payments, on both aggregated and actor specific levels. |

EARNINGS

The Q3 earnings season continues

Several companies from the media industry have reported their Q3 results this past week. Here are some of the highlights of what’s been reported:

- Google owner Alphabet reported total revenue of USD 79.69 billion in the third quarter, a 11% YOY growth which beat analysts’ expectations.

- YouTube advertising revenue were at USD 7.95 billion in Q3, representing a 12.5% YOY increase.

- USD 1.55 in earnings per share, slightly higher than analysts’ expectations of USD 1.45 per share.

- Alphabet shares dropped almost 7% in extended trading as the company’s cloud business missed analysts’ estimates.

- Netflix added 8,76 subscribers during the third quarter, beating Wall street’s expectations and resulting in a total of 247.2 million subscribers.

- According to Netflix, the growth is driven by their password sharing crackdown and a high interest for their ad-supported tier which grew its subscriber base with 70%.

- Q3 revenues were USD 8.54 billion, in line with analysts’ expectations.

- Netflix shares rose more than 12% after the earnings presentation.

- As previously rumored, Netflix now raises their prices in selected markets.

- Schibsted’s group operating revenue were NOK 3,853 million, representing a 3% YOY growth.

- EBITDA at NOK 741 million which is a 13 percent growth YOY, mainly driven by the news media segment.

- News Media segment had considerable profitability improvement driven by cost reductions, leading to an EBITDA of NOK 168 million and a margin of 9%.

- Schibsted repeats its outlook for next year, but not for 2023, as News Media is not expected to meet the reach the target due to higher costs for print products and weakening revenue trends from print and digital advertising in the short-term.

- Spotify’s monthly active users were up 26% YOY to 574 million in Q3. This is 2 million ahead of their own guidance and represents the company’s second largest Q3 net addition performance in history.

- Paying subscribers grew 16% YOY to 226 million, representing a net addition of 6 million and 2 million ahead of Spotify’s own guidance.

- Spotify recorded an operating profit with an income of EUR 32 million for the quarter, compared to a EUR 228M operating loss in Q3 2022.

- Spotify shares rose 10% on Tuesday after reporting its first quarterly profit in a year and a half, driven by successful price increases and effective cost-cutting measures.

- Norwegian telecoms operator Telenor reported third-quarter earnings above expectations, supported by growing mobile service revenue and lower energy prices in the Nordics.

- Service revenues were NOK 15.8 billion, which is an YOY increase of NOK 0.5 billion or 4%.

- Telenor now expects this business to show organic growth of above 3% in service revenues this year, previous guidance was “low-to-mid single-digit growth”.

- “The third quarter was strong … We delivered solid growth and earnings momentum in the Nordics and saw firm traction for synergy realisation in Asia,” CEO Sigve Brekke said in a statement.

- Revenue increased from SEK 21,096 million to SEK 21,997 million in Q3, a 4.3% YOY increase which beat analysts’ expectations.

- Telia’s TV and media business area, which includes TV4, decreased in revenue by 6.2% from SEK 1.898 million in Q3 2022 to SEK 1.780 million in Q3 2023.

- “TV and Media continue to experience a tough advertising market whilst in the midst of a major business transition” departing CEO Allison Kirkby commented.

- The company now expects its adjusted EBITDA, like for like, to grow by low single digits percentage in 2023. The previous forecast was for flat to low single-digit growth.

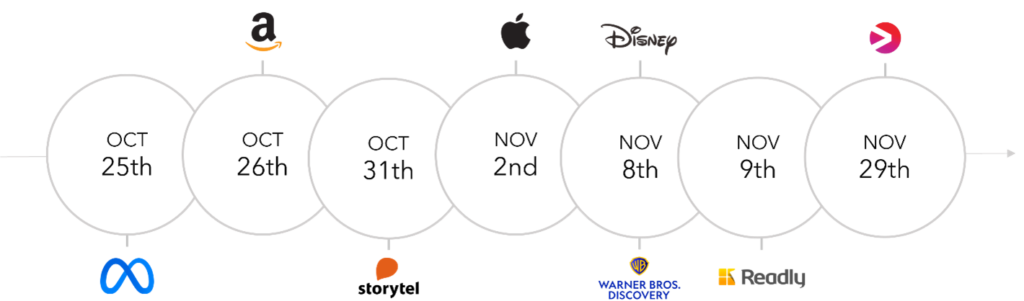

We still have several reports from the media industry ahead. Viaplay Group rescheduled its Q3 publication Tuesday, with reference to the “pending the conclusion of ongoing discussions with three of the Group’s largest shareholders, its debt providers and bondholders regarding the potential recapitalisation of the Group, and the completion of ongoing discussions regarding potential sales of non-core international operations and potential partnerships in various of its markets.” The report will be published on or before Wednesday 29 November, with the precise timing to be confirmed in due course.

|

|

Disney update terms of use against account sharing in Norway

DAZN and Sky retain Serie A rights in Italy

Disney gives investors a look at ESPN financials

Paramount+ to roll out ad tier in several markets

|

Mediavision in the News

Köp av medietjänster ökar: ”Ett hyfsat billigt nöje” – SR

Svenske husstandes medieforbrug slår ny rekord – Mediawatch

Trots krisande marknad – medieutgifterna ökar – Dagens Media

Summerat: Svenskarnas kontodelning kostar en miljard – Tidningen Näringslivet

Trots tuffa tider för hushållen – många fortsätter betala för strömningstjänster – SVT

Eksplosiv vækst i tv- og streamingindhold overvælder seere og får flere til at give op – Mediawatch

Så slår krisen mot tv-tittarna – Göteborgs-posten

Svenskarnas kontodelning kostar jättarna nära 1 miljard kronor – Dagens Industri

Trendbrott: Fler svenskar piratkopierar film och tv – Dagens Nyheter

Industry Events

Stockholm Film Festival: 8-19 November 2023, Stockholm, Sweden**

MIPTV: 15-17 April 2024, Cannes, France

* Mediavision will attend

** Mediavision will present