Newsletter 24th of April

NEWSLETTER

24 April 2024

These are the main topics this week:

- Q1 earnings season is in full swing

- Warner Bros. Discovery reveals Max pricing

- Skyshowtime’s ad-supported subscription is now live

EARNINGS

Q1 earnings season is in full swing

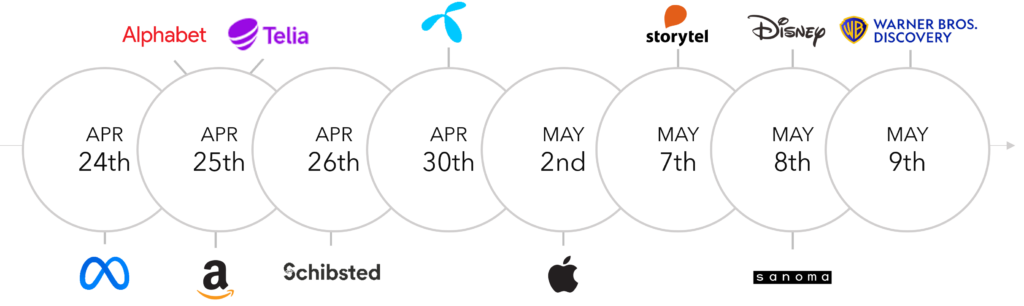

It has been an exciting week, with financial reports from several media industry actors. Here are some of the highlights of what’s been reported:

- Finnish operator Elisa’s revenue decreased by 1% to EUR 535 million in Q1 2024, mainly due to business disposals.

- Mobile service revenue increased by 5.8% to EUR 249 million in the first quarter.

- EBITDA decreased by 2% YOY, from EUR 183 million in Q1 2023 to EUR 180 million in the first quarter 2024. Comparable EBITDA, which excludes EUR 10 million in restructuring costs, grew 3.6% YOY.

- Elisa estimates full-year revenue to be at the same level or slightly higher than in 2023. Full-year comparable EBITDA is also expected to reach the same level or slightly higher than in 2023.

- Netflix added 9.33 million paid subscribers in Q1, resulting in a 16% YOY increase to a total of 269.6 million subscribers.

- Revenue for Netflix grew 15% YOY to USD 9.37 billion in Q1, exceeding the USD 9.28 billion expected by analysts.

- Net income was USD 2.33 billion, or USD 5.28 per share in Q1 2024, compared to USD 1.30 billion, or USD 2.88 per share, in Q1 2023.

- Netflix announced that it will not report quarterly subscriber numbers going forward. Netflix believes that the metric has lost its value since there are now multiple price points for memberships.

- Monthly active users of Spotify grew 19% YOY to 615 million in Q1 2024, slightly below its own expectations of 618 million.

- Premium subscribers grew 14% YOY to 239 million in the first quarter, in line with the forecast.

- Spotify’s total revenue grew 20% YOY to EUR 3.6 billion, which was in line with its own guidance.

- Operating income reached EUR 168 million, which is record high for the company in a single quarter. In Q1 2023 Spotify had an operating loss of EUR 156 million.

- Swedish telecom operator Tele2 reported a Q1 result in line with analysts’ expectations.

- End-user service revenue of SEK 5.3 billion, representing a 4% organic increase compared to Q1 2023.

- Total revenue amounted to SEK 7.2 billion, an increase of 2% compared to Q1 2023.

- Net profit from total operations was SEK 0.8 billion and stable YOY. Tele2 had earnings per share of SEK 1.20 in Q1 2024, compared to SEK 1.23 in Q1 2023.

- Tele2’s full year 2024 guidance and mid-term outlook has been reiterated.

- Viaplay subscribers in its core markets declined 19.5% YOY in Q1 2024 to 4.85 million, compared to 6.022 million in Q1 2023.

- Viaplay’s core operations (Nordics, Netherlands and Viaplay Select) grew 6% YOY in organic net sales to SEK 4,459 million, compared to SEK 4,279 million in Q1 2023.

- Total operating loss of SEK 473 million during the first quarter, compared to a loss of SEK -325 million in Q1 2023.

- Viaplay’s CEO Jørgen Madsen Lindemann commented that a new HVOD streaming package will be introduced this summer, as well as the implementation of initiatives to stop account sharing. Viaplay is also planning to launch a new sports news channel in most of their markets.

There are still more reports to come, stay tuned!

|

|

Insight Media & MarketsThis analysis tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. |

|

|

US House passes revised bill to ban TikTok or force sale…

…and The Senate passes the bill as well

Taylor Swift’s new album breaks multiple Spotify records

Discord now has more than 200m monthly active users globally

|

VIDEO

Warner Bros. Discovery reveals Max pricing

Last Friday, Warner Bros. Discovery shared information regarding the new streaming service Max, including pricing.

Max comes with a variety of subscription plans when launching in the Nordics in about a month, on the 21st of May. The cheapest tier, Basic (with ads), will cost 79 DKK / EUR 5.99 / 89 NOK / 89 SEK per month in the Nordics. The second least expensive tier is named Standard, which current HBO Max subscribers automatically will be transferred to. This ad free tier comes at a monthly cost of 119 DKK / EUR 9.99 / 129 NOK / 129 SEK. Lastly is the Premium tier, with features of more concurrent streams and 4K resolution among other features. The Premium tier will cost 149 DKK / EUR 13.99 / 159 NOK / 169 SEK per month.

Max will also offer sports as an add-on service, available across the Nordics. The sports package is sold separately and requires one of the above-mentioned subscriptions. The sports add-on package costs 40 DKK / 5 EUR / 50 NOK / SEK 260 per month. The reason for the significantly higher price in Sweden, is that it includes Allsvenskan and Superettan, the Swedish top and second tier domestic football leagues. Discovery holds the broadcasting rights for the leagues since 2020 until next year.

Customers of the “lifetime half price off” campaign, which was offered when HBO Max launched in the Nordics in 2021, will be automatically transferred to the Standard tier and keep their discount if they don’t change or cancel their subscription, although, at a slightly higher cost.

|

|

Insight: Nordic TV & StreamingThis analysis covers both the TV- and streaming markets in the Nordic countries. It rests on three pillars: the consumers, the market, and the actors. Analyzing the consumers takes us far – but not all the way. Studying the actors and the market as a whole is just as important. |

VIDEO

Skyshowtime’s ad-supported subscription is now live

Yesterday, Skyshowtime launched its ad-supported tier across all of its 20+ markets, including the Nordics. This makes Skyshowtime the first major streaming service to launch an ad-supported plan across all its markets simultaneously.

The introduction of the new ad-supported plan—Standard with Ads—is being offered alongside its existing ad-free plan, which has been re-named Standard Plus. The price for Standard with Ads in the Nordics is 49 DKK / EUR 4.99 / 59 NOK / 59 SEK per month, while the re-named and ad free Standard Plus sees a slight price increase. The ad free tier now costs 89 DKK / EUR 8.99 / 99 NOK / 99 SEK per month. Both subscription plans are offered at a discounted price when signing up for an annual subscription.

On Monday, SkyShowtime and Paramount Advertising International announced an exclusive partnership for Paramount to handle SkyShowtime’s advertising sales across all its markets. Paramount Global is co-owner of Skyshowtime. The Standard with Ads tier will have an average of four to five minutes of ads per hour, according to the streaming service.

Mediavision in the News

Denmark: HVOD, sport, password crackdown to boost streaming – Advanced Television

Mediavisons vd: Nya tider när globala streamers köper livesport – Dagens Media

Primes intåg stöper om sportmarknaden – Svenska Dagbladet

Mediavision: Growing demand for local content in the Nordics – Broadband TV News

Därför blir streamingtjänsterna allt dyrare – och sämre – PC för alla

Mediavision: Ad-Supported SVOD Gaining Traction in the Nordics – Media Play News

Mediavision: Starkt intresse för HVOD i Sverige – Dagens Media

Efterspørgslen på nordisk tv-indhold stiger men udbuddet kan ikke følge med – Mediawatch

Sweden: Interest growing in ad-supported streaming – Advanced Television

Svenskar vill se mer svenskt på streamad tv – Sveriges Radio

Illegal affär kostar filmindustrin miljarder – Dagens PS

Var fjärde svensk strömmar olaglig tv – SVT

Industry Events

Northern Waves: 24th October, Oslo, Norway

* Mediavision will attend

** Mediavision will present