Newsletter 31st of January

NEWSLETTER

31 January 2024

These are the main topics this week:

- Mediavision Industry Outlook 2024

- The Q4 earnings season continues

- Netflix’s first Nordic reality show is a success

OUTLOOK

Mediavision Industry Outlook 2024

For the fifth consecutive year, Mediavision has asked stakeholders in the Nordic media industry to give their view on the market development in an online survey. The findings from the survey, combined with our own reflections and insights, are presented in Mediavision Industry Outlook 2024. The report is now available to all of you upon request – please send an email to anton.ljung@mediavision.se to get your hands on a copy.

Here are a few of the key takeaways from this year’s edition.

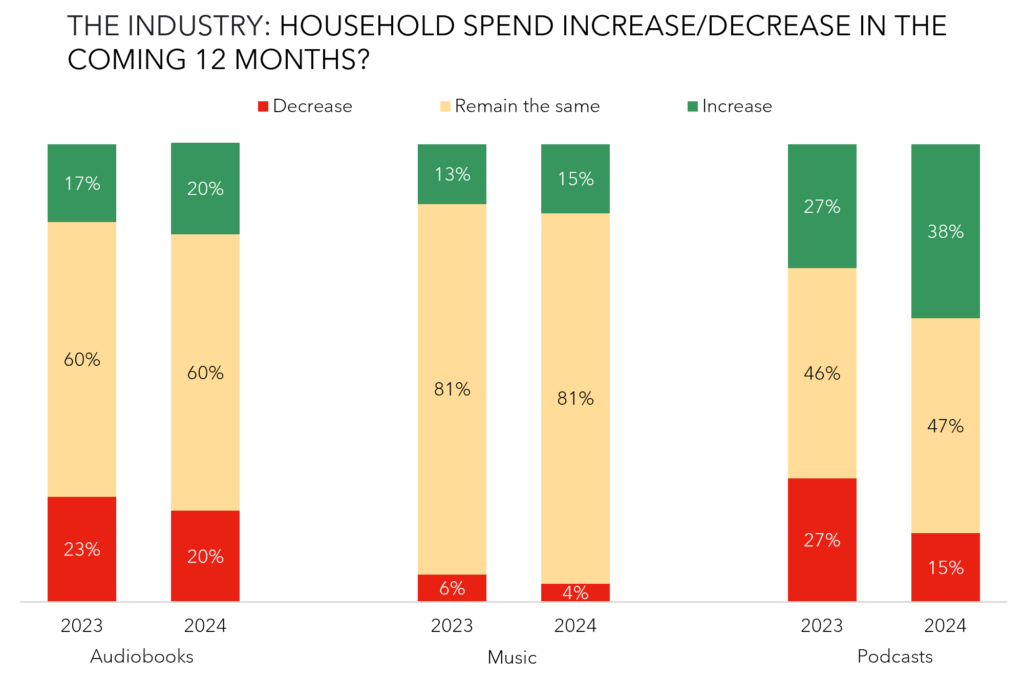

Audio 2024: Expectations rise for paid podcasts

The general view of the industry on Nordics’ household spend on audio is that it will be stable during 2024. However, a key difference compared to last year is found in podcasts as a larger number of respondents believe that household spend on podcasts will grow in 2024. Close to 40 percent of the respondents believe in an increase during the coming 12 months.

Music is the media category that the largest share of respondents believe will remain stable during 2024. In the case of audiobooks, most respondents expect household spend to remain stable, with the remaining participants evenly split between believing in an increase and a decrease

Video 2024: Outlook for trad TV pay market getting weaker over time

As online video continues to grow, few respondents expect traditional TV to grow and a full 74% of the respondents believe in a decrease in household spend in 2024. For SVOD, half of the respondents believe in a stable household spend in the coming 12 months, while most of the remaining respondents believe in an increase.

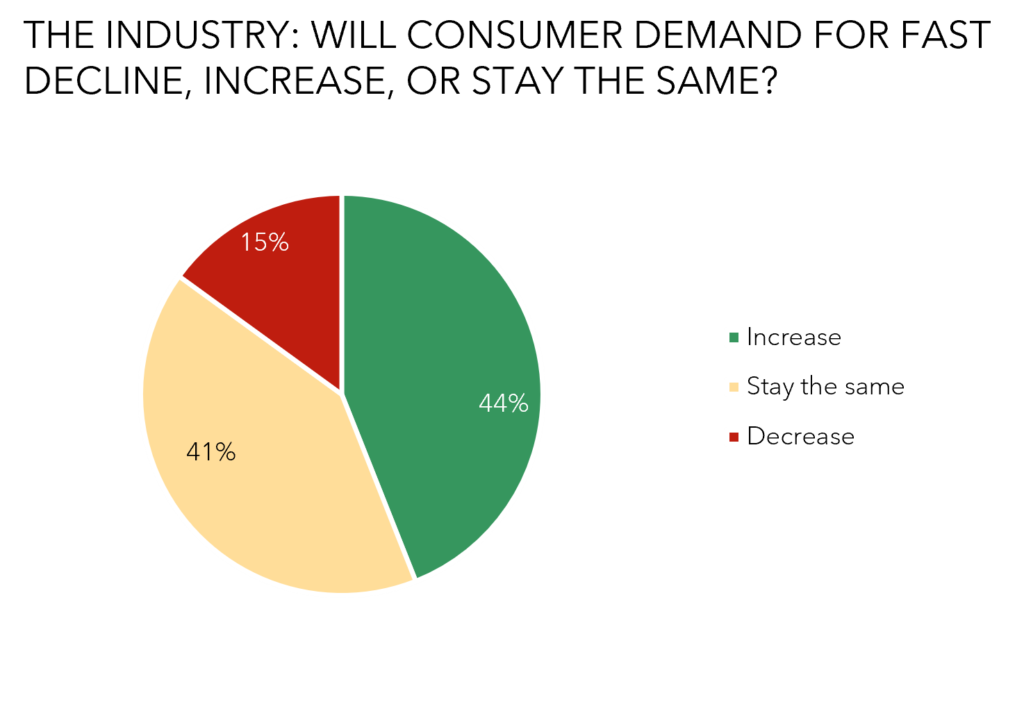

FAST (free ad-supported streaming TV) is still in its infancy on the Nordic market and the survey respondents are divided regarding the future consumer demand for FAST. Close to half believe in an increase, while an almost equal share believe in a more stable demand going forward.

Much more is presented in the full report, send an email to anton.ljung@mediavision.se to get your free copy.

|

|

Insight: Nordic TV & StreamingThis analysis covers both the TV- and streaming markets in the Nordic countries. It rests on three pillars: the consumers, the market, and the actors. Analyzing the consumers takes us far – but not all the way. Studying the actors and the market as a whole is just as important. |

|

|

Bookbeat reaches 300 000 subscribers in Finland

Apple is making major changes to iPhone due to EU law

Wondercraft, AI audio startup, raises USD 3M

Universal Music Group plans to pull song catalog from TikTok

Microsoft lays off in Activision Blizzard and Xbox divisions |

EARNINGS

The Q4 earnings season continues

This past week, the Nordic telecom operators Elisa, Tele2, and Telia have presented their Q4 earnings. Here are a few of the highlights from the reports:

- Revenue in Q4 for Finnish Elisa was at the same level as previous year’s level, EUR 563m, due to divestments and lower equipment sales.

- EBITDA grew by 3.4% in Q4, equivalent to EUR 6M, resulting in an EBITDA of EUR 191M.

- Elisa’s mobile service revenue increased by 4.4% YOY, to EUR 244M.

- Full-year revenue for 2024 is estimated to be same level or slightly higher than in 2023, with both mobile data and digital services expected to increase in revenue.

- Tele2’s end-user service revenue increased by 3% organically YOY to SEK 5.4 billion in Q4.

- Total revenue of SEK 7.7 billion which is an increase of 2% compared to Q4 2022.

- Underlying operating profit (ebitda-al) of SEK 2.6 billion increased by 4% organically YOY, mostly driven by end-user service revenue growth which was partly offset by inflationary pressures. An ebitda-al of SEK 2,581 million was expected, according to Infront.

- Tele2 delivered full year results for 2023 in accordance with guidance.

- The company announced the launch of a strategy execution program including SEK 600 million of cost reduction in three years.

- Telia’s fourth quarter results was generally in line with the expectations from analysts.

- Adjusted EBITDA result of SEK 7.5 billion was 1% slightly higher than analysts’ expectations, while the revenue of SEK 23.1 billion was -1%, slightly lower than analysts’ expectations.

- Telia’s TV and Media segment was challenged by further weakening in advertising markets. A 14% decline in advertising revenue during Q4 was partly offset by 6.5% growth in pay TV revenue.

- Two days prior the presentation of the Q4 report, Telia announced that the company had made non-cash-flow write-downs of SEK 4.1 billion relating to operations in Finland and TV and media, which affect the fourth quarter results.

Regarding the recent rumors of a possible sale of TV4, Telia’s CEO Allison Kirkby answered: “We never speculate on such rumors in the market. And I have been very clear that we are fully focused on making our television and media business better for our viewers, advertisers and owners moving forward”.

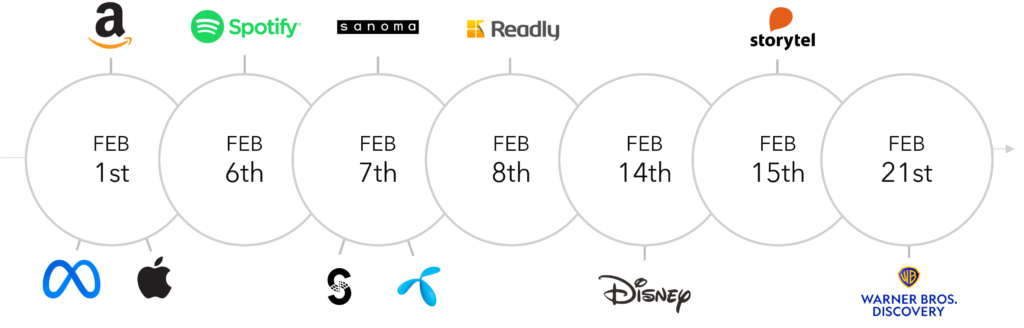

There are many Q4 reports to come from the media industry in the upcoming weeks, stay tuned!

|

|

Insight: Nordic Media & MarketsThis analysis tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. Published biannually. |

|

|

Netflix to remove lowest tier in most markets

Swedish government appoints investigation into film policy

Amazon Prime Video now include ads in the US

Crime and comedy dominate Finnish Golden Venla fiction awards

|

CONTENT

Netflix’s first Nordic reality show is a success

On January 12th, Netflix premiered its first Nordic reality series; Love is Blind Sweden. The series is a social experiment where singles seek true love and eventually propose to each other – without ever seeing the person. So far, Love is Blind Sweden seems to be a success. The series made the Netflix’s global top 10 list for TV (Non-English) two weeks in a row after the premiere, peaking at number 7.

Netflix was one of the first global streaming services to invest in local content in the Nordic region, but until now, the focus has been on fiction series and movies. Mediavision’s Content Analysis shows that Netflix is the Nordic local services’ main challenger when it comes to local produced content. Among the global streaming services, Netflix has the largest Nordic content library and is also the global service that the Nordic consumers rank highest in local content

|

|

Content AnalysisThis analysis provides in-depth understanding of the entire audio market – including audiobooks, music, podcasts, and radio. The analysis focuses on the digital transformation of both listening and consumer payments, on both aggregated and actor specific levels. |

Mediavision in the News

Illegal affär kostar filmindustrin miljarder – Dagens PS

Marie Nilsson: ”Mycket tycks peka åt rätt håll 2024” – Dagens Media

Var fjärde svensk strömmar olaglig tv – SVT

Kan bli det store gjennombruddet for denne typen TV-abonnement – Kampanje

Nordisk tv- og streamingmarked nærmer sig milepæl for omsætning – Mediawatch

Report: Nordic video market approaching €10bn in revenue – Advanced Television

Streaming subs in Nordics approach 20 million – C21 Media

Mediavision: Digitala ljudtjänster tar andelar på ljudmarknaden – Radionytt

Return of media piracy fuelling other crimes, expert says – Yle

Krisen i tv-branschen fortsätter – nu ökar piratkopieringen – Aftonbladet

Industry Events

MIPTV: 15-17 April 2024, Cannes, France

* Mediavision will attend

** Mediavision will present