Newsletter 7th of February

NYHETSBREV

7 February 2024

These are the main topics this week:

- The Q4 earnings season continues

- Nextory and Storytel books reach agreement

- Disney, Fox, Warner Bros Discovery to create joint sports streaming service

- Get ready for Super Bowl LVIII

EARNINGS

The Q4 earnings season continues

Numerous reports from major media companies have been presented this past week. Here are a few highlights of what has been reported.

- Amazon reported Q4 results that surpassed analysts’ estimates – resulting in the stock climbing more than 8% in extended trading.

- Net sales increased 14% to USD 170 billion in Q4, compared with USD 149.2 billion Q4 2022 and exceeding analysts’ expectations.

- Sales at Amazon Web Services climbed 13% in the fourth quarter to $24.2 billion, in line with Wall Street’s forecast.

- Amazon’s advertising unit saw sales grow 27% YOY to UDS 14.7 billion. Last month, the company began showing ads on Prime Video content – a move analysts project will generate substantial new revenue for the business.

- Revenue for Apple were UDS 119.6 billion in Q4, an increase of 2% YOY, higher than analysts’ forecast.

- Apple reported USD 33.92 billion in net income during the quarter, up 13% from the same period last year.

- Apple’s CEO Tim Cook confirmed that its services – Apple Music, Arcade, News, Podcasts – have 1 billion subscribers. This represents a doubling of subscribers over the past four years.

- Apple’s board of directors declared a cash dividend of USD 0.24 per share of the company’s common stock.

- Apple shares fell more than 4% in extended trading, partly driven by management providing details about outlook for the current quarter, suggesting weakness in iPhone sales.

- Meta’s revenues for the fourth quarter increased by 25% year over year, while expenses decreased by 8% year-over-year to USD 23.73 billion, resulting in its operating margin more than doubling to 41%,

- Meta’s headcount was 67,317 as of December 31st, demonstrating a 22% YOY decrease, following extensive layoffs.

- Facebook daily active users were USD 2.11 billion on average for December 2023, an increase of 6% YOY.

- A first-ever dividend payment was announced as Meta said it will pay investors a dividend of 50 cents a share on March 26. The company also announced a USD 50 billion share buyback.

- Meta’s stock soared 14% in extended trading after reporting better-than-expected results.

- Sanoma group’s net sales decreased in Q4 to EUR 253 million, compared to EUR 260 in Q4 2022. In Media Finland, net sales declined mainly due to lower advertising and external printing sales.

- The Group’s operational EBIT in Q4 decreased to EUR -51 million compared to -21 million in Q4 2022. A result of lower operational earnings and higher items affecting comparability (IACs).

- Sanoma reports higher personnel costs due to salary inflation and normalized bonus provisions and higher TV program costs driven by Elisa deal, as well as higher amortization of TV broadcasting rights before year-end.

- In 2024, Sanoma expects that the Group’s reported net sales will be EUR 1.29‒1.34BN, slightly lower than 2023. Regarding the operating environment Sanoma expects the Finnish advertising market to decline slightly.

- Schibsted group had revenues of NOK 4,082 million in Q4, underlying stable YOY (with neutral foreign exchange basis).

- EBITDA of NOK 684 million for Schibsted in Q4, up 5% YOY mainly driven by News Media.

- In Q4, Schibsted’s News media segment had stable underlying revenues YOY, considerable profitability improvement driven by cost reductions, leading to an EBITDA of NOK 266 million, and a margin of 13%.

- The year-end report shows that the company is now selling its position in Viaplay. The share of Viaplay has fallen 96.5 percent since Schibsted’s purchase last fall.

- Monthly active users of Spotify grew 23% YOY to 602 million in Q4 2023 – 1 million ahead of its own guidance. In total 28 million, representing the second largest Q4 net addition performance in our history.

- Subscribers grew 15% YOY to 236 million in Q4, representing a net addition of 10 million, contributing to a record full year of net addition of 31 million.

- Total revenue for Spotify grew 16% YOY to EUR 3.7 billion.

- Spotify operating loss was EUR 75 million for Q4. Excluding one-time charges, Spotify generated EUR 68 million in adjusted operating profit.

- Telenor reported a fourth-quarter net loss of NOK 7.68 billion, compared to prior year’s profit of NOK 37.91 billion.

- Service revenues for Telenor were NOK 16.1 billion in Q4, which is an increase of NOK1.1 billion or 7%, compared to the same period last year. The organic growth in service revenues was 4.9%.

- EBITDA was NOK 8.5 billion and increased by 3.9% on organic basis.

- The Nordic business area delivered organic service revenue growth of 3.8% and organic EBITDA growth of 5.1%.

- Telenor’s financial outlook for 2024 is low single-digit organic growth in Nordic service revenues and medium single-digit organic growth in both Nordic and Group EBITDA.

There are still a few reports to come this earnings season, stay tuned!

|

|

Insight: Nordic TV & StreamingThis analysis covers both the TV- and streaming markets in the Nordic countries. It rests on three pillars: the consumers, the market, and the actors. Analyzing the consumers takes us far – but not all the way. Studying the actors and the market as a whole is just as important. |

|

|

Viaplay Group and TV3 Group enter Baltic agreement

Disney combines Junior with Disney Channel in the Nordics

Google launches an AI-powered image generator…

Universal Music Group plans to pull song catalog from TikTok

…as well as AI tools for music creation

Viaplay raises the price for basic tier with movies and series |

AUDIO

Nextory and Storytel Books enters new partnership

After over a year of conflict, Nextory and Storytel Books have entered a new content agreement. The new agreement includes an addition of around 20,000 titles to Nextory’s service. The addition cover both e-books and audiobooks from publishing groups such as Norstedts, Lind & Co and Storyside.

– We are happy to be able to offer Nextory’s users these titles again and that we have reached a solution that feels reasonable to both parties. It is also a gratifying development for the authors, whose books now reach an even wider audience and thus contribute to promoting reading and democratizing access. That is, ultimately, the goal of Nextory, says Shadi Bitar, CEO and founder of Nextory.

The contract negotiations between Nextory and Storytel Books have been rather turbulent. Storytel initially withdrew all its titles from Nextory, which responded by denounce Storytel to the Swedish Competition Authority. This caused Storytel to back down on certain points and resume negotiations. The agreement includes additions of titles in Sweden, Denmark, and Finland

|

|

Insikt: LjudmarknadThis analysis provides in-depth understanding of the entire audio market – including audiobooks, music, podcasts, and radio. The analysis focuses on the digital transformation of both listening and consumer payments, on both aggregated and actor specific levels. |

|

|

Spotify’s podcast Joe Rogan’s show expands to other platforms

Keskisuomalainen acquires Karjalainen and other newspapers

Sveriges Radio to lay off 180 employees

Spotify now has 11 percent of the US audiobook market

|

SPORTS

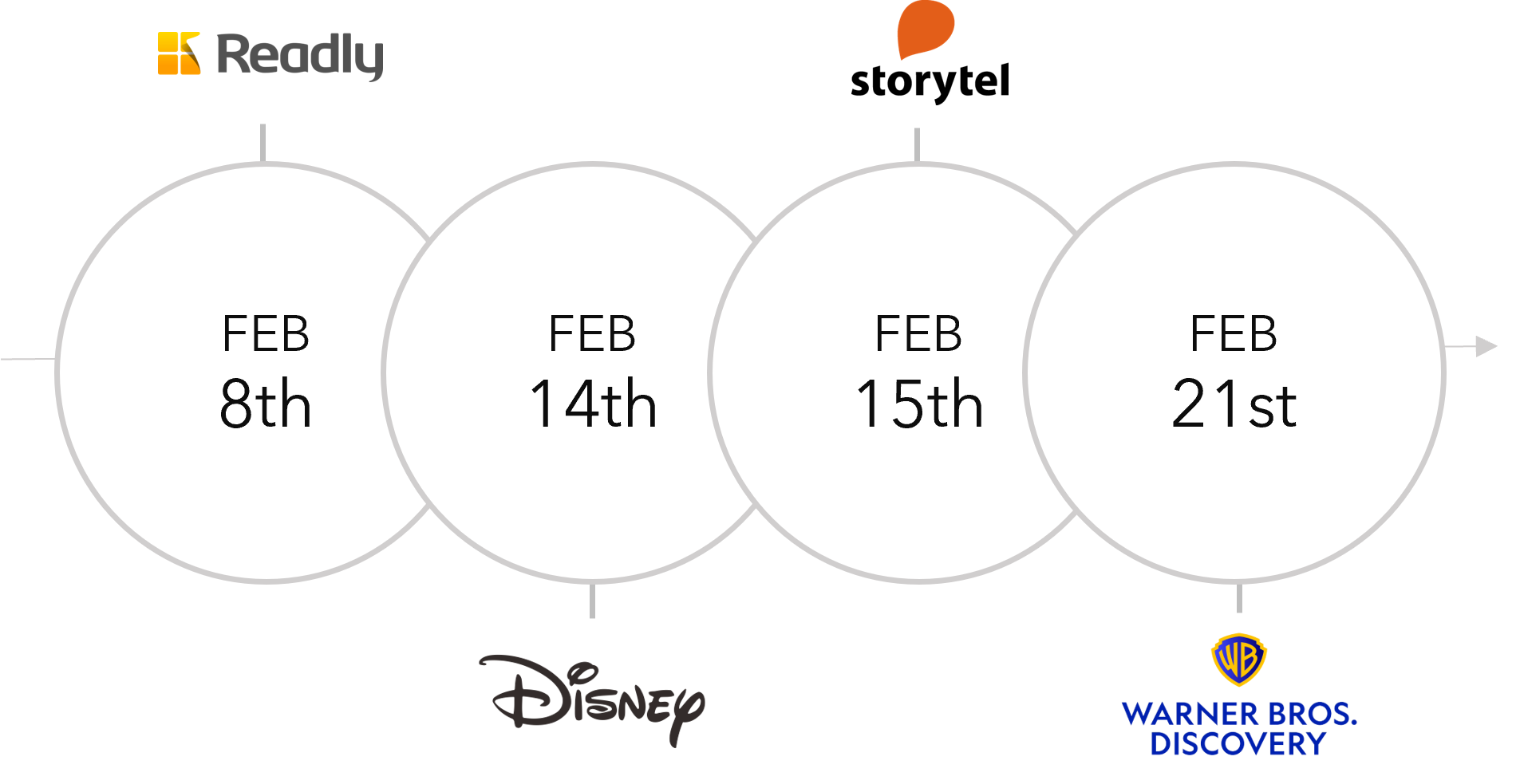

Disney, Fox, Warner Bros Discovery to create joint sports streaming service

Fox, Walt Disney’s ESPN and Warner Bros Discovery have announced that they will launch a joint sports streaming service in the US later this autumn. The platform will bring together the companies’ portfolios of sports networks, including content from all the major professional sports leagues and college sports.

The new service, which is yet-to-be-named, will offer an all-in-one package of programming that includes television channels, such as ESPN, TNT and FS1, as well as sports content that is streamed. Subscribers will also have the option of subscribing to the service as part of a streaming bundle from Disney+, Hulu or Max.

The service will aggregate content and offer fans a wide range of sports content. The aim is to provide a new and differentiated experience to serve sports fans, particularly those outside of the traditional pay TV bundle.

Bob Iger, CEO of The Walt Disney Company said, “The launch of this new streaming sports service is a significant moment for Disney and ESPN, a major win for sports fans, and an important step forward for the media business. This means the full suite of ESPN channels will be available to consumers alongside the sports programming of other industry leaders as part of a differentiated sports-centric service. I’m grateful to Jimmy Pitaro and the team at ESPN, who are at the forefront of innovating on behalf of consumers to create new offerings with more choice and greater value.”

|

|

Sports AnalysisThis analysis provides in-depth understanding of the entire audio market – including audiobooks, music, podcasts, and radio. The analysis focuses on the digital transformation of both listening and consumer payments, on both aggregated and actor specific levels. |

SPORTS

Get ready for Super Bowl LVIII

One of the world’s biggest sports events is taking place this Sunday; the Super Bowl. The matchup is between the San Francisco 49ers and defending Super Bowl champions Kansas City Chiefs, and is held at the Allegiant Stadium in Las Vegas, Nevada. Last year’s Super Bowl averaged 115.1 million viewers, making it the most watched Super bowl of all time. But this year’s event may exceed this number and set a new audience record, at least when looking at the regular season’s viewership.

During the 2023 regular season, NFL games on television and streaming has averaged 17.9 million viewers, a year-over-year increase of 7 percent. The 12 postseason games leading up to Super Bowl averaged 38.5 million viewers on television and digital platforms, a year-over-year increase of 9 percent. This suggest that a new viewership record could be coming up for this year’s Super Bowl.

The NFL’s audience has primarily been concentrated in the US and Canada. However, as the NFL gains more popularity, its reach is expanding, with an increasing number of global fans tuning in to watch NFL games.

The broadcasting rights for the Super Bowl is not sold individually in the US as the cost is covered under what each of the networks pay for the general NFL broadcasting rights. Fox, NBC, and CBS all pay around USD 2 billion for the rights, which is more than double of the amount that each company paid under the previous NFL broadcasting deal. The current deal was agreed upon in 2021. Additional, Amazon Prime pays USD 1 billion for the “Thursday Night Football” window solely. The three networks (Fox, NBC, and CBS) alternate the broadcasting rights for the Super Bowl, with CBS having its turn this year.

The Super Bowl is a major revenue driver. Each 30-second ad during the event costs roughly USD 7 million. Two years ago, the Super Bowl LVI produced around USD 578.4 million of in-game ad revenue. The event also boosts the local economy of the host city – in 2020 the Super Bowl brought 4,500 jobs to Miami and had an overall economic impact of USD 571 million.

In the Nordics, Telia holds the rights for the NFL in Finland and Sweden, while TV2 has the broadcasting rights in Denmark and Schibsted in Norway. Last year, four percent of the Nordic 15-74-year-olds stated interest in watching the American Football league NFL. This is concluded in Mediavision’s Sports Analysis.

Mediavision in the News

Illegal affär kostar filmindustrin miljarder – Dagens PS

Marie Nilsson: ”Mycket tycks peka åt rätt håll 2024” – Dagens Media

Var fjärde svensk strömmar olaglig tv – SVT

Kan bli det store gjennombruddet for denne typen TV-abonnement – Kampanje

Nordisk tv- og streamingmarked nærmer sig milepæl for omsætning – Mediawatch

Report: Nordic video market approaching €10bn in revenue – Advanced Television

Streaming subs in Nordics approach 20 million – C21 Media

Mediavision: Digitala ljudtjänster tar andelar på ljudmarknaden – Radionytt

Return of media piracy fuelling other crimes, expert says – Yle

Krisen i tv-branschen fortsätter – nu ökar piratkopieringen – Aftonbladet

Industry Events

MIPTV: 15-17 April 2024, Cannes, France

* Mediavision will attend

** Mediavision will present