Newsletter 10th of November

NEWSLETTER

10 November 2021

The earnings season isn’t over just yet – this week, Disney will present the results for its fiscal fourth quarter and full year 2021. Ahead of the report, we thought it would be useful to get a quick look at the current state of the industry – see below for a compilation of the latest reported SVOD figures from major players.

- Storytel and Acast present Q3-reports

- Global SVOD subs – ahead of Disney’s (Q4) report

COMPANY REPORTS

Storytel and Acast report on Q3 performance

Last Friday, Storytel reported its earnings for the third quarter. Net turnover (including streaming and books) grew by 17.3% compared to last year to a total of SEK 714 million in Q3 2021. EBITDA amounted to SEK -12.4 million – much better than the expected -50 million. Streaming sales amounted to 583 million in Q3 2021, an increase of +19% compared to the same period last year.

Despite this, the company (once again) lowered its forecast for total number of paying subscribers in 2021 to 1.82-1.84 million, from previous estimate 1.95-2 million. The downgraded forecast is derived from the Indian market, where churn has increased as a result of the Indian government banning recurring card payments. Following this, Storytel’s stock fell -16,9% on Friday, but has since bounced back.

In conjunction with the report, Storytel also stated that…

- The collaboration with Spotify will come into effect in the first half of 2022

- The company joins the UN Global Compact initiative

- It has acquired the rights to distribute Anna Jansson’s novels (including the Maria Wern-series) in additional languages via its publishing company StorySide

Further, Acast presented its Q3 2021 report yesterday.

Net sales grew by 89% compared to Q3 2020, and amounted to SEK 256.1 million in Q3 2021. EBITDA amounted to SEK -42 million. The operating loss was SEK -52.7 million. Total “listens” reached 891 million and average revenue per listen improved to SEK 0.30, from SEK 0.17 in the same period 2020. The number of shows available on the Acast platform reached 35,000. Further, Acast communicated that it will collaborate with Samsung in an international partnership, where Acast will be one of the inaugural partners for the European launch of Samsung Free, a new podcast app.

|

|

Berlingske cuts down on printed holiday newspapers

12 of UK’s largest media brands join Climate Content Pledge

Gothenburg designated as UNESCO City of Literature

Google News in Spain to reopen after government amends rules

Bauer Media launches digital subscription to radio channels

Amazon joins live audio game with ‘Project Mic’ |

COMPANY REPORTS

Ahead of Disney’s Q4-report

The reports season isn’t finished just yet. Today, Disney will present the results from its fiscal full year and Q4 2021. Mediavision’s latest analysis of the Swedish TV & Streaming market concluded that new Disney Plus subscriptions made up more than half of all net additions of SVOD subscriptions in the past 12 months.

So, what is the market expecting from Disney’s report? The consensus mark for revenues is set to USD 18.77 billion, implying a growth of +27,6% compared to the same quarter last year. Among other things, Disney is expected to have benefitted from the success of Shang-Chi and the Legend of the Ten Rings, the growing popularity of Disney Plus, and a bounce back in revenues from parks, experiences, and products.

This week, Disney communicated a special offer on Disney Plus as part of the company-wide ‘Disney Plus Day’ promotions. Starting Monday (Nov 8th) through Sunday (Nov 14th), new and eligible returning Disney Plus subscribers can aquire the service for EUR 1.99 (available in all Nordic countries) for one month. Further, Disney has announced the premiere of 13 movies from the Marvel Cinematic Universe adapted to the IMAX projection format.

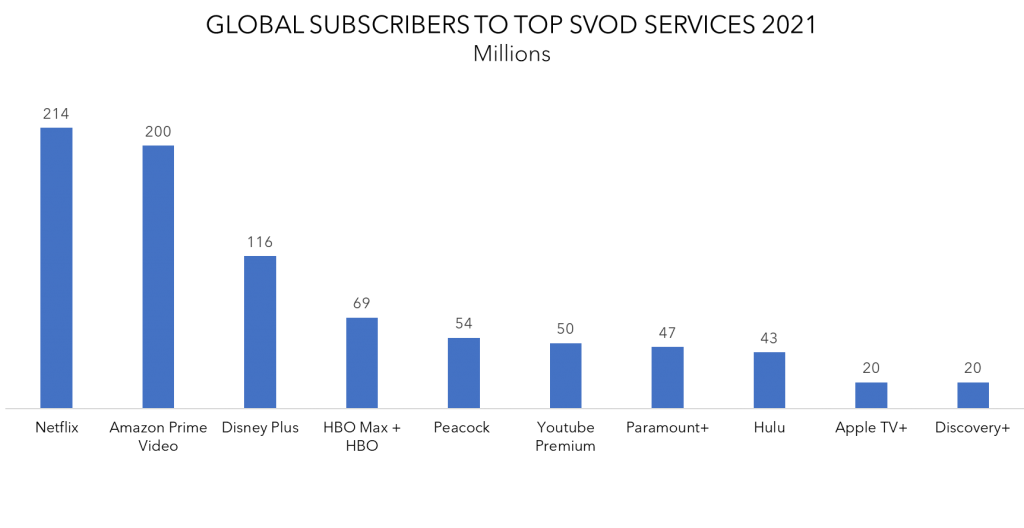

So, the question is – how big of a leap towards the top has Disney Plus taken in this past year? As of today, these are the latest subscriber figures reported by the top services.

Netflix reamins at top – but for how long? Research from Digital TV Research show that Disney Plus could surpass Netflix by 2026.

Amazon does not report Prime Video subscribers separatly, but occasionally communicate the total number of global Prime Members. This latest figure, presented here, was released in Q1 2021. The Amazon Prime membership was made available to Swedish consumers this fall, but is not yet offered in the other Nordic contries.

Disney Plus figures refer to their fiscal Q3 ended July 3rd, 2021.

HBO – Global HBO Max and HBO subscribers consist of domestic and international HBO Max and HBO subscribers, and exclude free trials, basic and Cinemax subscribers.

Peacock – this figure was communicated in Q2 2021. Comcast did not release any new figures in Q3 but cited “growth of a few million” during its earnings call. Note that Peacock include free signups in this figure, whereas the number of “monthly active accounts” is significantly lower – around 20 million in July 2021.

Youtube Premium – this figure was released in Q2 2021, note that it includes subscribers to both Premium and Music offerings.

Paramount Plus – this figure also include other streaming platforms from ViacomCBS, e.g. Showtime. However, the company’s Q3 2021 earnings report stated that “subscriber additions in the quarter were led by Paramount+”.

Apple is yet to release figures on subscribers to Apple TV Plus, however, the company claimed to have less than 20 million subscribers as of July this year. The IATSE told CNBC that in doing so it allowed the company to pay lower crew rates than streamers with more than 20 million subscribers.

Discovery’s Q3 report last week stated that Discovery Plus added 3 million subscribers YOY in Q3 2021.

|

|

Streaming – Nordic FamiliesMediavision has recently published a new analysis focusing on families with children and its TV and streaming habits. We strive to broaden and deepen knowledge about families with children’s purchases and consumption of streaming services. The analysis covers the Nordic market. |

|

|

Former Disney executives buys Danish Moonbug EntertainmentYousee now has less than 1 million TV customers

Cmore invests in Young Adult content for 2022

Danish TV distributors warns that new VAT will impact churn

Netflix to make games available via the App Store on iOS |

DIGITAL AD REVENUE

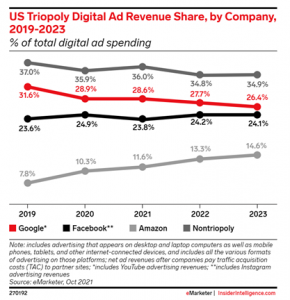

US triopoly digital ad revenue share 2019-2023

It’s certainly no secret that a few large players grabs a significant piece of the advertising market. This infographic from eMarketer tells us how much – and a possible development going forward.

|

|

Nordic cinema admissions back to pre-pandemic levels

AMC quarterly revenues beat projections

BBC Studios merges APAC and EMEA businesses

Lionsgate is officially exploring a sell of its Starz channel |

Mediavision in the News

Sweden Ups SVOD Sub Base by 350,000 – Media Play News

Sporträttigheterna: ”Fler aktörer kommer att konkurrera” – Journalisten

350 000 nya SVOD-abonnemang i Sverige senaste året – Börsvärlden

Ilta-Sanoma, PlayPilot launch streaming guide in Finland – Rapid TV News

Mediavision says HBO Max to benefit in Nordic region from lower price, extra stream and fictional slant – Telecom Paper

Over halvdelen af danske husstande betaler for at se sport – MediaWatch

One of the most powerful competitive tools for video streaming services is content exclusivity. Sports rights are by far one of the most attractive content genres in this regard. However, audiobook streaming services rarely apply this tactic. Could exclusive content be a competitive tool also for the audio book actors going forward? – Boktugg

Industry Events

TV-Dagen: 11 November, Stockholm, Sweden**

MIPCOM: 11-14 October, Cannes, France

Bergen International Film Festival: 20-29 October 2021, Bergen, Norway

SportsPro OTT Summit: 15-18 November 2021, London, UK

IBC: 3-6 December 2021, Amsterdam, Netherlands

CTAM Europe Executive Management Programme: 20-25 March 2023, Fontainebleau, France * Mediavision will attend ** Mediavision will present