Newsletter 26th of April

NEWSLETTER

26 April 2023

These are the main topics this week:

- Mediavision: Streaming services back in strong growth, driven by TV operators

- The Q1 earnings season continues

- TV4 announces shutdown of C More

SVOD

Mediavision: Streaming services back in strong growth, driven by TV operators

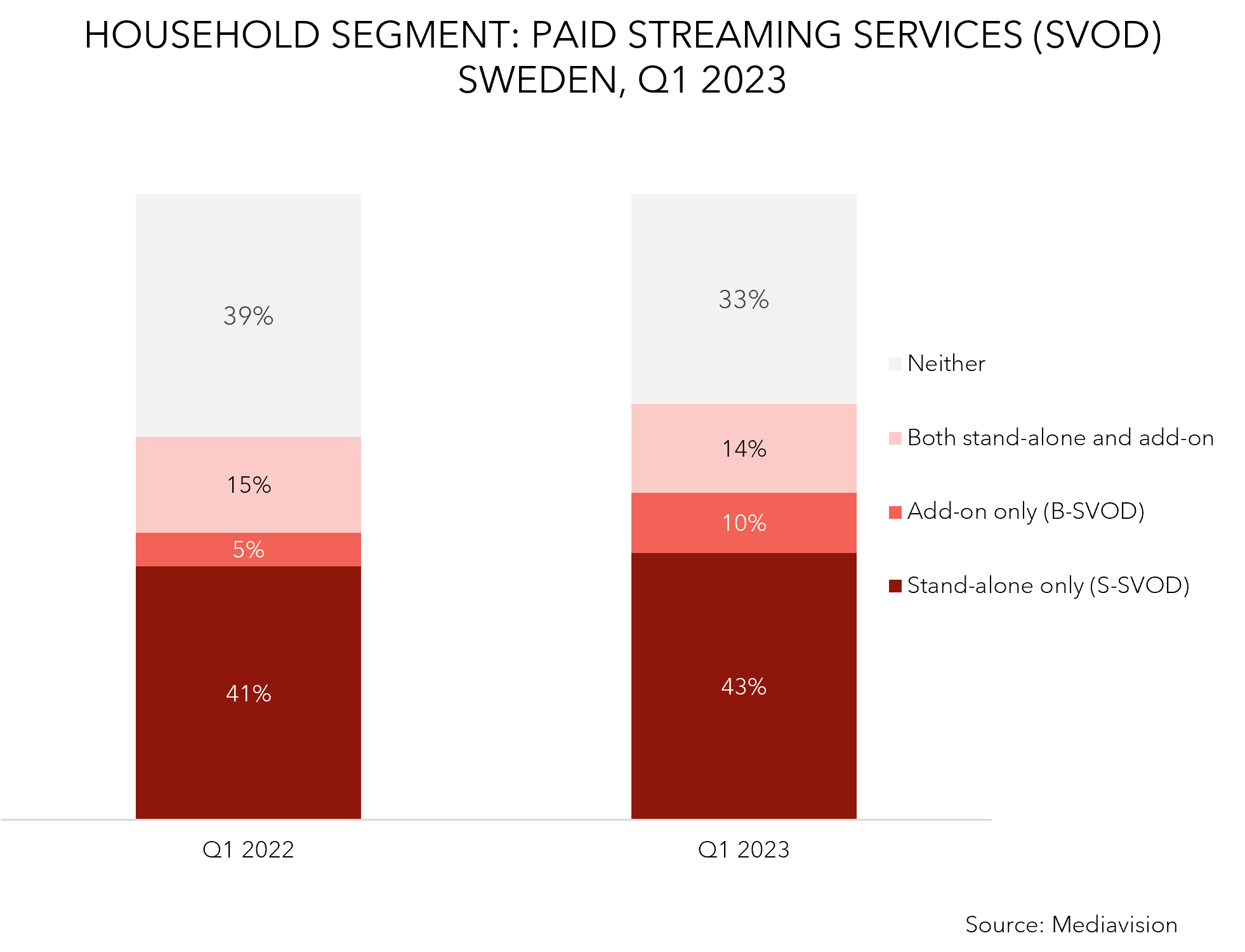

During the first quarter of 2023, growth is again noted for paid streaming services, so-called SVOD. This comes after a clear slowdown last year. The fact that more households now choose to buy streaming subscriptions is primarily explained by bundling with pay TV. This is concluded by Mediavision in its latest analysis of the Swedish streaming market.

Household penetration for paid streaming services in Sweden increased by 9 percent in the first quarter, compared to the same period in 2022. This is a shift, after a period of relatively slow growth. Today, close to 70 percent of households in Sweden have at least one paid streaming service, either as a stand-alone subscription or bundled with another service (Buy through SVOD or B-SVOD, in short), usually pay TV. It is mainly these bundled offers that are now driving growth. This type of subscription increased by a whopping 15 percent in Q1 and is now found in every fourth household.

Read up on the full press release here, with commentary from Mediavision’s CEO Marie Nilsson.

|

|

Insight: TV & StreamingThis analysis tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. Published biannually. |

|

|

Amazon Prime Video announces first Swedish documentary

Viaplay launches on Roku devices in Canada, UK, and the US

Telia enters agreement with Viaplay in Denmark

Warner Bros. Discovery confirms docuseries about Sanna Marin |

EARNINGS

The Q1 earnings season continues

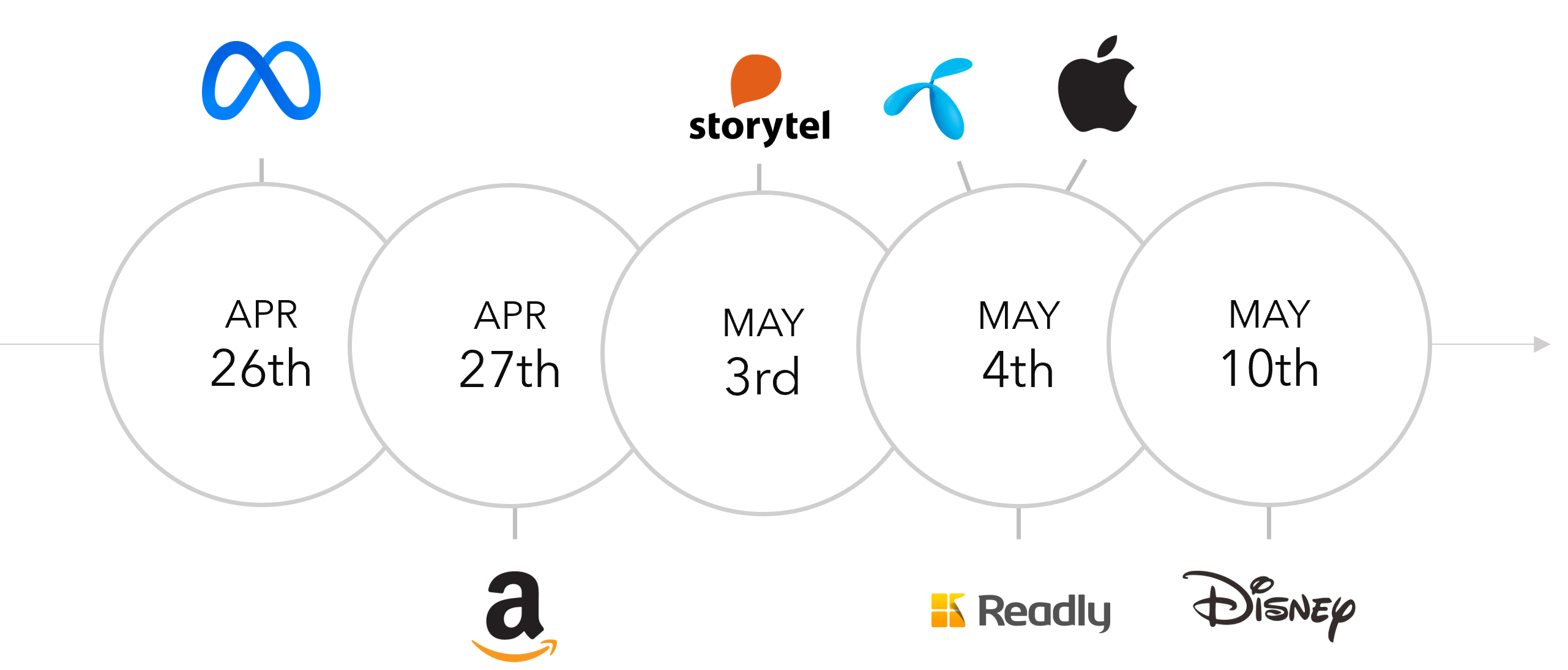

The Q1 earnings season is in full swing and several media companies both in the Nordics and globally have presented their results for the first quarter of 2023 this past week. Here is a recap of some of the highlights of what has been reported.

- Google parent company Alphabet’s first quarter revenue and earnings topped analysts’ estimates.

- Alphabet’s revenue rose 3% to USD 69.79 billion from USD 68 billion in Q1 2022.

- YouTube advertising revenue was USD 6.69 billion, a decline from USD 6,87 billion in the first quarter of 2022.

- The company reports that its board has authorized a $70 billion share buyback.

- To manage the weak advertising market, Google has had to make cost cuts, including layoffs of about 6% (12,000 employees) of its workforce in January. This month, CFO Ruth Porat announced “multi-year” cuts to real estate, employee services and equipment, among others.

- The U.S. telecom company AT&T added 272,000 fiber broadband plans in Q1 2023, the 13th straight quarters with more than 200,000 net adds.

- Revenues grew 1.4% year-over-year to USD 30.14 billion, falling just short of analysts’ expectations of USD 30.27 billion.

- AT&T shares dropped on Thursday after the company’s revenue came up short of Wall Street’s expectations, and the stock closed more than 10% down.

- Yesterday, Spotify presented what the company called its “strongest Q1 since going public in 2018”, as monthly active users grew by 22% compared to Q1 2022, to 515 million.

- Premium subscribers grew 15% year-over-year to 210 million, which was led by Europe and Latin America.

- Spotify’s total revenue grew 14% year-over-year to EUR 3 billion, which was below Spotify’s expectation of EUR 3.1 billion and explained by variability in the advertising business.

- Spotify’s operating loss amounted to EUR 156 million, which was less than the projected EUR 194 million, helped by lower marketing spend.

- Last Friday, the Swedish telecom operator Tele2 presented its Q1 results, which was in line with analysts’ expectations.

- End-user service revenue amounted to SEK 5.1 billion, an increase of 4% organically compared to Q1 2022, due to strong performance in the Baltics and Sweden B2B.

- Total revenue was SEK 7.0 billion, an increase by 3% organically compared to the same period in 2022.

- “This year is an important one for Tele2. We aim to build Sweden’s best 5G network, while also executing on an IT transformation that will improve every step of the digital customer journey and experience.” Kjell Johnsen, CEO at Tele2, commented.

- Full-year 2023 and mid-term financial guidance is repeated by Tele2.

- Swedish telecom operator Telia presented its Q1 results this morning, which were in line with analysts’ expectations.

- Revenue increased 5.7% year-over-year from 21,818 million to SEK 23,069 million.

- Operating income decreased 22,5% year-over-year from 2,437 million in Q1 2022 to SEK 1,887 million.

- Telia’s outlook for 2023 remains unchanged.

- Telia Company announced it has agreed to sell its Danish operations and network to electricity and internet provider Norlys at an expected enterprise value of DKK 6.25 billion (approximately SEK 9.5 billion).

- Viaplay’s paying subscribers grew 60% in the first quarter compared to the same period in 2022, from 4,783 to 7,643 million.

- 30% organic sales growth for Viaplay Group, with reported sales of SEK 4,537 million compared to 3,324 million in Q1 2022.

- Total reported operating result of SEK -325M, with particularly visible losses in the international business area, which amounted to SEK 1.1 billion.

- “The combined operating losses for our international business reflected our investment in the Polish Formula 1 rights, the launch of Viaplay in the US and Canada, the scaling-up of our UK operations and the Polish and Dutch ARPU mix”, commented Anders Jensen, CEO of Viaplay Group.

Stay tuned for more highlights from this earnings season!

|

|

Insight: Nordic Media & MarketsThis analysis tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. Published biannually. |

|

|

Spotify announce integration with BeReal

Book sales were stable in Sweden during the first quarter

Den som skrattar förlorar podcast moves from Acast to Podplay

Allente to raise the prices of its linear TV subscriptions in Denmark

|

VIDEO

TV4 announces shutdown of C More

Yesterday, Telia owned TV4 announced that C More and TV4 Play will be merged into one platform. That platform will be TV4 Play, and thus the long-held rumor of C More’s shut-down confirmed. Users will still find free content on TV4 Play and simultaneously, C More’s paying users will become TV 4 Play “plus users”. Plus user will be able to stream the same content as currently available on C More, in addition to other content.

“TV4 is all of Sweden’s TV channel and everyone can still gather in front of Masked Singer Sweden on Fridays, free of charge. At the same time, C More users will recognize C More’s content, but on a new service. At the same time, we give all of Sweden the opportunity to stream, for example, sports, drama, entertainment, and news on TV4 Play. It will also be possible to watch content with or without advertising”, says Mathias Berg, CEO of TV4.

The merger of the two services will take palce after the summer, but no exact date has yet been communicated. C More’s customers will receive information about the transition later this spring.

|

|

Insight: Nordic TV & StreamingThis analysis covers both the TV- and streaming markets in the Nordic countries. It rests on three pillars: the consumers, the market, and the actors. Analyzing the consumers takes us far – but not all the way. Studying the actors and the market as a whole is just as important. |

Mediavision in the News

Research: Sweden sees strong SVoD growth in Q1 – Advanced Television

Strömningstjänsterna växer igen – Journalisten

Marie Nilsson: Hur ser morgondagens bundling ut? – Dagens Media

Fler prenumererar – men annonserna minskar – Sveriges Radio

Nordic streamers, broadcasters prepare for 2024 Champions League rights cycle –

C21 Media

Et stigende antal svenskere betaler for podcasts – Mediawatch

Sweden: Significant growth in podcast households – Advanced Television

TVOD in Sweden reaches record levels in 2022 – Broadband TV News

Netflix drag – så ska kontodelare jagas – Svenska Dagbladet

Industry Events

Nordic Media Days: 10-12 May 2023, Bergen, Norway

Stockholm Film Festival: 8-19 November 2023, Stockholm, Sweden

* Mediavision will attend

** Mediavision will present